Australian Tax Relief: Understanding the New Tax Cuts for Every Taxpayer

BlogTable of Contents

- Australia announces the largest change in income tax in the coming ...

- Reading week 9 Personal income tax rates in Australia - Personal Income ...

- Tax bracket creep costing every Australian worker more than a decade ...

- Individuals statistics | Australian Taxation Office

- Australian Tax System in 2023 - Tax Rate in Australia - YouTube

- A Beginner's Guide to Understanding Australian Income Tax 2024 - YouTube

- ATO Tax Brackets 2024-25: Understanding Australia's Income Tax Changes

- Australian Income Tax Explained | How Tax Brackets Work | Tax Basics ...

- Tax time in Australia: Things to do now to maximise your return in 2024 ...

- New Tax Brackets 2024 Australia - Dixie Frannie

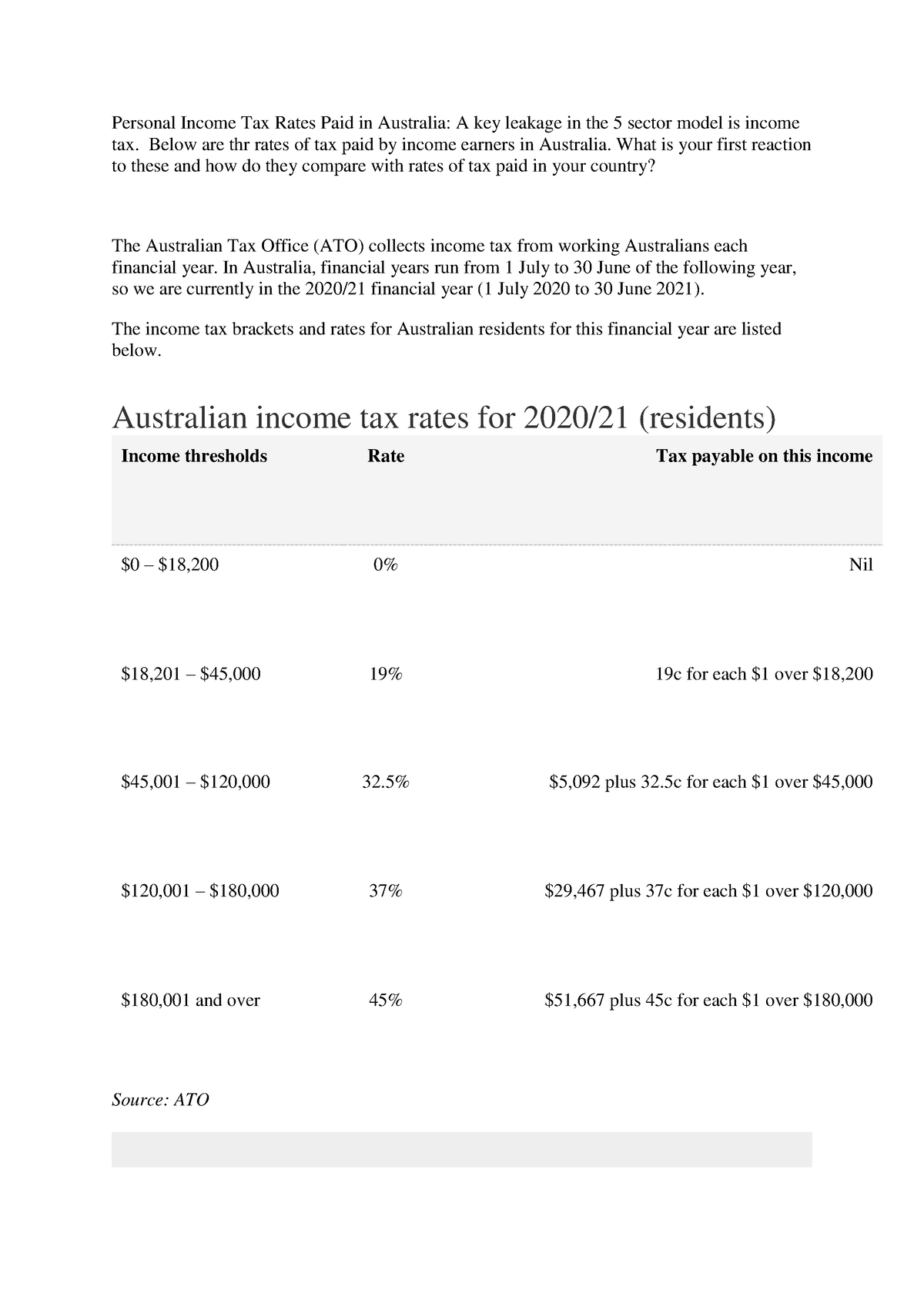

As announced on budget.gov.au, the Australian government has introduced new tax cuts aimed at providing relief to every taxpayer in the country. This move is part of a broader effort to stimulate economic growth, increase disposable income, and reduce the financial burden on individuals and families. In this article, we will delve into the details of these tax cuts, exploring how they will benefit Australian taxpayers and what changes can be expected in the tax landscape.

What are the New Tax Cuts?

The new tax cuts are designed to be progressive, offering more significant reductions to lower- and middle-income earners. According to the information available on budget.gov.au, the tax cuts will be implemented in stages, with the first stage focusing on reducing the tax burden for those who need it most. This approach is expected to boost consumer spending, as individuals will have more money in their pockets to spend or save as they see fit.

Benefits for Australian Taxpayers

The introduction of these new tax cuts is anticipated to have several benefits for Australian taxpayers. Firstly, it will lead to an increase in disposable income, allowing individuals and families to better manage their finances and make ends meet. Secondly, by putting more money back into the pockets of consumers, the government hopes to stimulate economic activity, potentially leading to job creation and business growth. Lastly, the tax cuts are seen as a way to offset the rising cost of living, providing relief to those who are struggling with expenses such as housing, healthcare, and education.

Key Changes and Implementation

To understand the full scope of the new tax cuts, it's essential to visit budget.gov.au for the most up-to-date information. The website provides detailed breakdowns of the tax changes, including when they will come into effect and how they will be implemented. Key changes include adjustments to tax brackets and rates, ensuring that as income grows, the tax system remains fair and does not disproportionately burden any particular group. The government has also outlined plans for how these changes will be phased in, ensuring a smooth transition for all taxpayers.

The introduction of new tax cuts for every Australian taxpayer marks a significant shift in the country's tax policy, aimed at fostering economic growth and improving the financial well-being of its citizens. By reducing the tax burden, especially for lower- and middle-income earners, the government is taking a proactive approach to addressing the challenges faced by many Australians. For the latest information and to download relevant PDF documents detailing the tax cuts, taxpayers are encouraged to visit budget.gov.au. This resource will provide comprehensive insights into how the new tax cuts will work and what benefits taxpayers can expect to receive.

As the Australian economy continues to evolve, initiatives like these tax cuts play a crucial role in supporting both individuals and businesses. Whether you're looking to understand how the tax cuts will affect your personal finances or your business operations, staying informed through official government sources like budget.gov.au is key. With the new tax cuts, Australia is poised to embark on a new chapter of economic prosperity, and every taxpayer is set to benefit from these changes.